Getting Started with Crypto Futures Trading: 10 Cardinal DOs and DON’Ts for Beginners

So, you’re excited about all the buzz you’ve been hearing about crypto futures trading, and people making huge profits these days, and you’re thinking about jumping all in, but you’re clueless, as you’ve never done it before. Perhaps you’ve that one “crypto friend” who’s making shitloads of money by trading futures in cryptocurrency, and you want to do it too… Well, don’t worry, a couple of months ago, I was on the same boat, but after doing a few dozen trades, things got easier, so you can say, I’ve been there, done that!

Note: I’m relatively new to only crypto futures trading, but I’ve been into the crypto trading markets (SPOT) since last bull run, and I’ve gone from $5000 to $30,000 to $120k+, exited about half my capital profitably, and then come down to $10k

when the market suddenly collapsed, so I’ve indeed seen all the highs and lows. Anyway, coming back to the million dollar question – how much money can you make as a crypto trader? Well, the good news is that Sky is the Limit literally, but less than 1% of the people actually manage to do that. So, let’s take one step at a time, and start by understanding the basics of crypto futures trading.

The idea of making money whether the market goes up or down, and doing it with “leverage”, sounds like a golden ticket, right? I’m not going to lie, it can be, but it’s also a fast-track to losing all your money, if you don’t know what you’re doing.

I remember my first few weeks. I was excited, confident, and a little bit naive. I thought I could just follow a few charts, make a couple of good calls, and be a genius. The reality was a harsh lesson when I lost $400 when I didn’t put stop loss, and with ETH surging, with strong bullish sign, I thought there’s no way it could go down till $3440. I learned that this isn’t a game of luck; it’s a game of strategy, discipline, and, most importantly, risk management – specifically, it’s about Risk:Reward Ratio (commonly referred to as RRR)

So, before you place your first trade, let me walk you through everything I wish I had known from the very beginning of my journey. Think of this as the conversation I’d have with my past self, or a friend I’m trying to save from making the same mistakes I committed.

But, if you’re completely new, I don’t recommend you to start with trading crypto futures, but rather gets the basics right, learn chart reading, analysing things, understanding how to open an account on CEX, how to connect your wallet, understanding types of wallets, and only then proceed with trading crypto futures,

Recommended Reading: Basics of Crypto Chart Reading

What is Crypto Futures Trading in Layman’s Terms?

In regular crypto trading, you buy and hold a coin like Bitcoin (BTC) or Ethereum (ETH). If the price goes up, you sell and make a profit, but if it goes down, you lose money, if you sell it at a lower price.

However, crypto futures trading is different, since you’re not buying the actual crypto. Instead, you’re buying a contract that says you agree to buy or sell a cryptocurrency at a specific price at a future date. And, the cool part? Well, most platforms offer perpetual crypto futures, which means the contracts don’t have an expiry date, implying that you can hold them as long as you want.

This lets you do two things:

- Go Long: You believe the price will increase. You “buy” a contract, and if the price goes up, you profit from the difference.

- Go Short: You believe the price will decrease. You “sell” a contract, and if the price drops, you buy it back at a lower price, and profit from the difference.

And, the secret sauce here is leverage; this is the part that gets everyone excited. Leverage allows you to control a much larger position than the capital you actually have. For example, with 10x leverage, and a $100 investment, you can open a $1,000 position.

Real-life Example

Let’s say I believe that after the recent rally, Bitcoin will drop in value by 2%. I have $1,000 in my account. I can go “short” on BTC with 10x leverage, which means I’m controlling a $10,000 position. If BTC’s price drops by 10%, my $10,000 position would make $1,000 profit!

So, my initial $1,000 just doubled in matter of few days – sounds amazing, right?

But here’s the flip side of the coin; if BTC’s price goes up by just 10%, I’ll lose my entire $1,000, and my position gets automatically closed by the exchange. And, this is called liquidation, which brings me back to my first major point… So, it’s important to set Stop Loss, and different target profit levels, but we’ll get to that in a bit.

The Absolute DOs and DON’Ts for a First-Timer

This is where I learned the hard way. Following these simple rules could have saved me a lot of grief, and a lot of money.

The DOs

- DO Start with a Small Amount of Capital You Can Afford to Lose. Seriously, I can’t stress this enough; this isn’t your retirement fund. This is money you’re using to learn and experiment; think of it as paying for an education.My fourth “big” trade ended in a swift liquidation because I was overconfident that ETH can’t drop below $3400, and I had opened a Long position from $3807 to $3940, after all the technical analysis, reading the chart. However, crypto market is very volatile, and one Tweet from Donald Trump or bad news like SEC issuing notice to XRP can cause a lot of FUD (Fear Uncertainity Doubts) in the market, can cause a steep decline unexpectedly.

Start small, get a feel for the market, and build your confidence before you even think about increasing your trade size, and capital infused.

- DO Learn About Risk Management. This is the bedrock of all successful traders, and rather the “holy grail”. My biggest mistake was focusing on potential profits and overlooking the risks.

- Position Sizing: I now risk no more than 1% of my total capital on a single trade. If I have $1,000, my maximum loss on any one trade is $10. And, how do you do that?

- Stop-Loss Orders: This is the answer – it’s your safety net; a stop-loss is an order that automatically closes your position if the price moves against you to a certain point. It prevents a small loss from becoming a catastrophic one. I learned to never, ever open a position without a stop-loss.

- DO Use a Low Leverage Ratio (2x-5x). The temptation to use 50x or 100x leverage is insane, but it’s a rookie trap. The higher the leverage, the smaller the price movement required to liquidate your entire position. Start with something low, like 2x or 3x. It gives your trade room to breathe and reduces the chance of getting wiped out by a minor market fluctuation.

- DO Have a Trading Plan and Stick to It. Don’t just jump in because you “have a good feeling.” I used to do this all the time initially, and it rarely ended well. A good plan includes:

- Entry Point: The specific price at which you will open your position.

- Take-Profit Point: The price at which you will close your position to lock in a profit.

- Stop-Loss Point: The price at which you will exit to limit your loss.

- Reasoning: Why are you taking this trade? Is it based on a chart pattern, a news event, or technical indicators like the Relative Strength Index (RSI)?

- DO Study the Market. Before trading a coin, understand its volatility. Some coins are a lot wilder than others in terms of price movements. I spend a lot of time on platforms like TradingView, looking at charts, learning about technical indicators, and trying to spot trends. You’ll hear terms like “support” and “resistance.” These aren’t very hard-to-understand – they’re just levels where the price has historically struggled to go higher (resistance level) or lower (support); learning to recognize them, and then making well-calculated decisions can be a game-changer in your trading journey.

The DON’Ts

- DON’T Over-leverage: I’ve already mentioned this, but it’s worth repeating; high leverage is a double-edged sword. It can make you rich, but it’s far more likely to make you broke. Don’t be greedy, and even “flash close” the position, when you’ve made enough profit, and suddenly see that the market is moving against you.

- DON’T Overtrade: I used to think more trades meant more profits. It’s the opposite. Every trade costs money in fees, and every trade introduces more risk. I now wait for high-probability setups that align with my strategy, instead of constantly trying to find opportunities. Quality over quantity, always.

- DON’T Let Emotions Rule Your Decisions: Fear of Missing Out (FOMO) and greed are the two of the biggest aspects that new traders fall prey to. I once saw a coin pumping and jumped in with a large position, only to watch it crash seconds later. The fear of missing a rally made me abandon my plan and take a loss, but I’ve learnt my lessons. Similarly, greed can make you hold a winning position for too long, hoping for more, only to see it reverse and turn into a loss. So, long story short – stick to your plan, and be happy with the profits you’ve already generated – after all, it’s the money the bank, or rather wallet balance in this case, in your futures trading account, which counts, at the end of the day.

- DON’T Ignore Funding Fee: This is a small but critical detail for perpetual futures. Every few hours, traders either pay or receive a funding rate to keep the contract price in line with the spot price. If you’re in a “long” position when the funding rate is positive, you have to pay a fee. If you’re short, you receive a small payment. It’s usually a tiny percentage, but if you’re holding a position for a long time, especially with high leverage, it can really eat into your profits. I learned this the hard way when I held a long position through a few funding cycles and realized how much I had paid in fees, and ultimately made just $38 in profits, while I could have encashed $100+ if I’d have sold off earlier.

- DON’T Risk More Than What You Can Afford to Lose: There’ll be days when you’ll feel “on top of the world” or invincible, but remember this is where the road gets rusty. Just because you had a few good days, don’t start risking more than what you can afford to lose. I’ve seen my friends lose $100k+ overnight, and by the way, on August 9, 2025, over $110,000,000 worth of $ETH shorts got liquidated in less than 60 minutes, when ETH pumped from 3900 to 4100+ mark, and eventually crossed 4200 (and is rapidly surging as you read this post).

My Personal Trading Experience

Let’s analyse a real-life example from my own experience –

The Setup

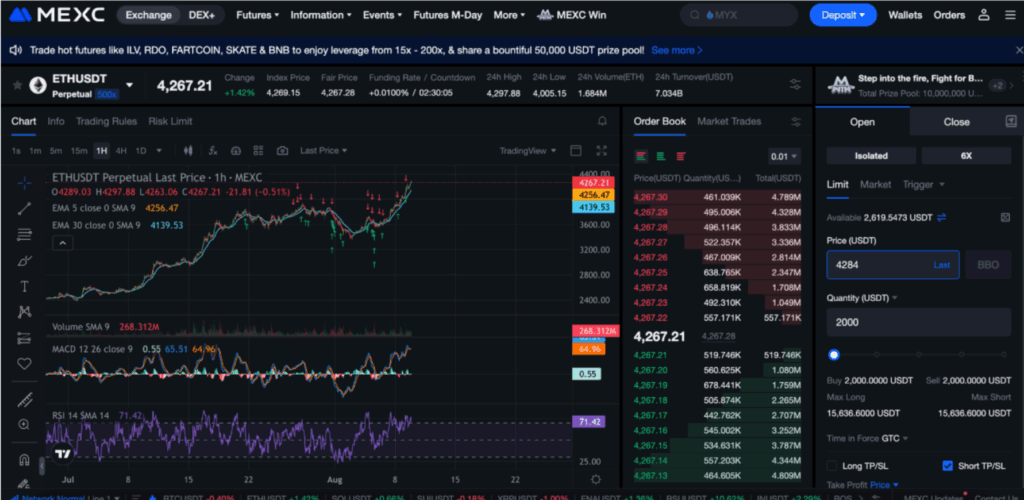

I’m looking at the ETH/USDT perpetual futures chart. I see a clear ascending triangle pattern forming. The price is hitting a resistance level at $4,000 repeatedly, while the lows are getting higher. To me, this suggests that buyers are gaining strength and are likely to push the price above the $4,000 resistance.

My Plan

- Action: Go long.

- Capital: I have $2,000 in my account.

- Risk: I’ll risk 1% of my capital, which is $20.

- Entry: I’ll enter a position as soon as the price breaks above $4,000.

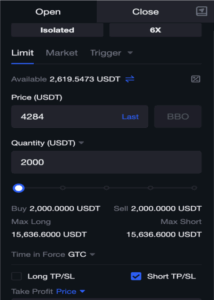

- Leverage: I’ll use 5x leverage. This means my position size will be $500, but I’ll only be using $100 of my own capital as margin ($100 x 5 = $500). My total account is $2,000, so I’m not over-extending myself.

- Stop-Loss: I’ll place my stop-loss at $3,900. If the price breaks down and hits this level, my position will be automatically closed, and I’ll lose my pre-defined $20.

- Take-Profit: I’ll set a target at $4,200, which is based on the height of the triangle pattern, and totally dependent on your chart reading, and decision-making.

The Outcome

The price breaks out, I enter my position. The market is volatile, but it doesn’t hit my stop-loss. After a few hours, the price rises to $4,200. My position is closed automatically, and I’ve made a profit of $20 (4% on my $500 position, or 1% on my total capital, which is a good return for one trade).

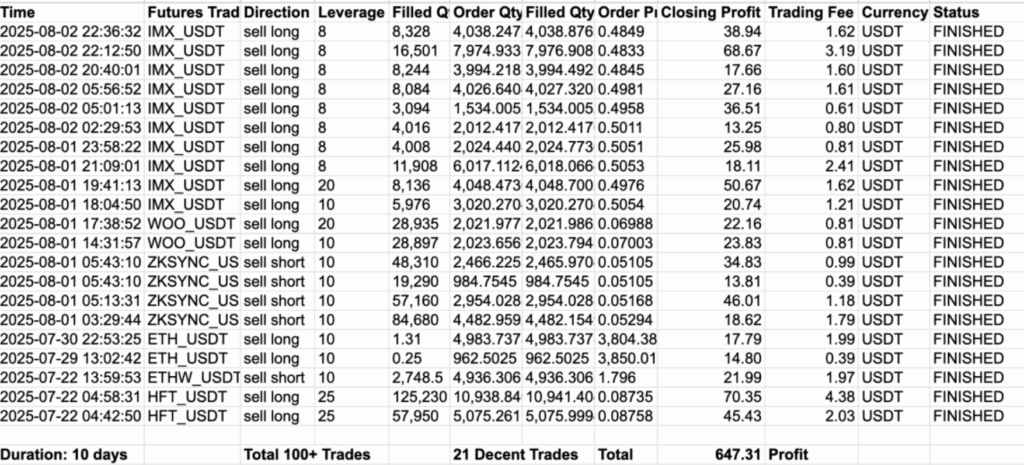

I felt great. I didn’t get lucky; I followed a plan I had researched, I managed my risk, and I didn’t let the small fluctuations scare me into selling early, and here are some of my trades (again don’t even think about 10X+ leverage – I’ve already done 200+ trades profitably now, and I follow strict risk management rules, not to risk > 1-2% of my capital.

Yes as you may notice, I just studied price movements of IMX (ImmutableX) and did all these trades to generate a total profit of $200+ within 24 hours, and total of $647 in just 10 days with $4000 trading capital, but then there are days like today (August 9/10) when I see that price action is very erratic, and just because the crypto marketing is exploding, I don’t blindly open long positions and enter into risky positions, because you never know when a quick crash is on the cards, and you can suddenly lose way more than what you gained over the last few weeks, or even months (which I did earlier, with $400-500 losses in single trades, wiping out 2 weeks of my hard-earned capital within fraction of a second)

How to Get Started?

In order to get started with crypto futures trading, you’ll need assistance with identifying the best crypto futures trading platform, but unfortunately there’s no straightforward

answer here. Sure thing, Binance is the most popular choice, but not all the tokens are listed on Binance Futures Crypto, so I’m covering this topic in detail in another article.

Note: The screenshot you see is that of my MexC crypto futures trading account

Golden Tip: Even before you spend a dollar, open a demo trading account, and do at least 20-30 trades, and once you’re able to consistently get it right, start your crypto futures trading journey with a small $300-500 capital, and then gradually keep increasing it, by generating profits over a period of time.

The Bottom-Line

Crypto futures trading is not a get-rich-quick scheme. It’s a skill that you have to acquire slowly, and it requires discipline. Start slow, be patient, and prioritize learning over making a profit. The market isn’t going anywhere, so take your time. If you follow the dos and don’ts I’ve laid out, you’ll be on a much safer and more sustainable path than I was when I first started.

For keeping this simple, I’m wrapping up this post here, as there’s shitloads of information to cover, and I’ll be covering everything, right from different types of orders (limit, market etc), chase order, flash close, isolated/cross margins, and plenty of other terms, which might sound like Greek & Latin to you, but I’ll try to explain every single concept in simple language, just the way I explain it to my 11 year old son.

- WAGMI (No – I’m not going to spoon-feed everything, c’mon Google it!)

Om Thoke